I'm in my 50s, married with one daughter.

After having lived in Canada for forty years, I have relocated to the Pacific island of Formosa in the past few years, enjoying the paradise life style and involving myself in community service and volunteer work.

I bought my first stock at 19, and began studying the markets from books and seminars. I began applying technical analysis in 1997, which has helped me even more in managing my own money and others who listened.

I went online in 1999, and by 2003 the circle has grown so much that I was spending hours everyday answering emails and sending out updates. A decision was made to leave my family business and started my own advisory service.

I am proud to admit that I am a big fan of Warren Buffett, and have followed his two rules of investing for most of my career.

Rule #1 - never lose money.

Rule #2 - never forget rule #1.

Most folks in the business only pay lip service to these two rules, but as people around me know that I live by them.

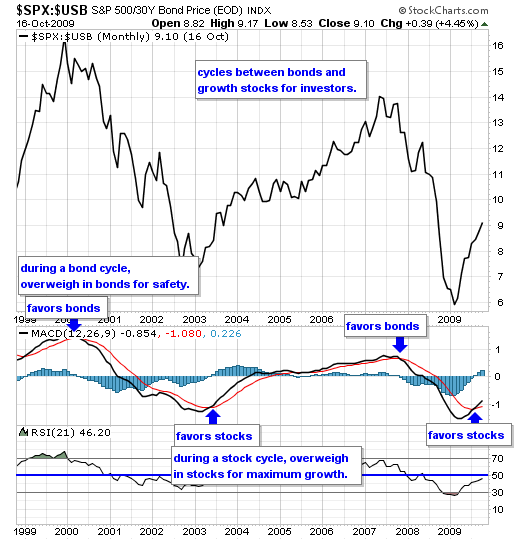

Our long term "stocks/bonds" model has helped me and others to sidestep the global financial disasters in 2000, and again in 2008. I have no doubt it will alert us again before the next catastrophe strikes.

We have only one service for all subscribers. The cost is a buck a day.

No bull, no fluff, and no noise.

We send out daily updates of the markets to stay in touch.

We send out weekend updates and analysis of the markets.

I also let you look over my shoulder as to when and what I am buying or selling, by sending email alerts to your mailboxes in real time.

You have unlimited email support from me personally, 24/7.

Looking forward to sharing and learning with you.

Get to know us.

Our simple trading model

by Jack Chan.

The Psychology of Trading

by Dr John Doyle.

Testimonials

First hand knowledge of the service.

Sample Updates

» Sample Gold Update

» Sample Energy Update

» Sample Global Indexes Update

» Sample Growth Sector Update

John S.

» More Testimonial